"The tax code is a monstrosity and there's only one thing

to do with it. Scrap it ... and hope it never rises again to terrorize the American people."

— Steve Forbes, editor-in-chief of

Forbes magazine

FAIRTAX FAQ'S FROM A-Z

Click on the questions below to view the answers for a particular subject area:

- What is taxed?

- Exactly what taxes are abolished?

- How does the rebate work? (includeds HHS rebate table)

- Why not just exempt food and medicine from the tax? Wouldn't that be fair and simple?

- Is the 23% FairTax higher or lower when compared to the income taxes people pay today?

- Does the FairTax rate need to be much higher to be revenue neutral?

- How is the Social Security system affected under the FairTax?

- How does the FairTax affect Social Security reform?

- Is consumption a reliable source of revenue? (includes income/consumption graph)

- How is the tax collected?

- Why is the FairTax better than our current system?

- Is the FairTax fair?

- How does the FairTax protect low-income families, individuals and retirees on fixed incomes?

- Is it fair for rich people to get the exact same FairTax rebate from the federal government as the poorest person in America?

- What about senior citizens and retired people?

- Are seniors taxed twice on savings, once when they saved it, now again when they spend it?

- How much do prices for goods and services go down under the FairTax?

- Should the government tax medicine and health care?

- Should the government tax services?

- How does the FairTax affect income tax preparers, accountants, and many government employees?

- What about the home mortgage deduction?

- What will happen to charitable giving?

- Will corporations get a windfall with the abolition of the corporate tax?

- Does the FairTax burden the retail industry?

- How are state tax systems affected, and can states adequately collect a federal sales tax?

- How will the plan affect economic growth?

- What economic changes come at the retail level with the FairTax?

- What happens to interest rates?

- What happens to the stock market, mutual funds, and retirement funds?

- What happens to tax-free bonds?

- How does this affect U.S. competitiveness in foreign trade?

- What about border issues?

- Does the FairTax improve compliance and reduce evasion compared to the current income tax?

- Can the FairTax really be passed into law?

- What other significant economies use such a tax plan?

- What about the flat tax? Would it be better and easier to pass?

- Can Congress just simply raise the rate once the FairTax is passed into law?

- Could we end up with both the FairTax and an income tax?

- Is the FairTax just another conservative tax scheme? Or just another liberal tax scheme?

- What assumptions have been made about government spending?

- How does the FairTax affect government spending?

- Why is it necessary to have a constitutional amendment?

- How does the income tax affect our economy?

- How will this plan affect compliance costs?

- What about value-added taxes (VATs), like they have in Europe and Canada? Are they not consumption taxes?

- What will we experience in the transition from the income tax to the FairTax?

- I

know the FairTax rate is 23 percent when compared to current income

taxes. What will the rate of the sales tax be at the retail counter?

- Is the FairTax progressive? Do the rich pay more and the poor pay less as a percentage of their spending?

- Can you summarize House Bill H.R. 25/S. 122 - "The Fair Tax Act"?

- Who are the Americans for Fair Taxation (AFFT)- FairTax.org?

If you don't find the answers to your questions in our FAQ's, check the menu under

Research or

Facts.

Need the entire FAQ in a printer friendly format? It's available

right here in PDF format.

Still can't find the answer to your FairTax question? Please consult the

Pennsylvania Volunteer Directory

to contact a FairTax community coordinator near you or call 724-941-9443 for more assistance.

The FairTax Act

Frequently Asked Questions From A-Z

-

What is taxed?

The FairTax is applied to the sale of all new consumer goods and services at the

final point of consumption. Used items are not taxed. Business-to-business purchases for the

production of goods and services are not taxed.

» back to FAQ index

-

Exactly what taxes are abolished?

The FairTax is a total replacement, not a reform of the current federal

tax code. It replaces all federal income taxes including, personal, estate, gift, capital gains,

alternative minimum, Social Security (FICA), Medicare, self-employment, and corporate taxes.

» back to FAQ index

-

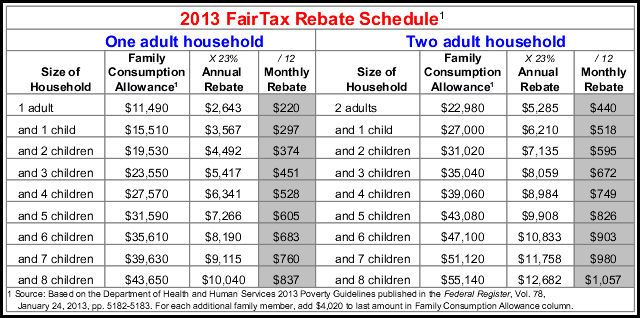

How does the rebate work?

All valid Social Security cardholders who are U.S. residents will be eligible for

a monthly rebate equivalent to the FairTax paid on essential goods and services, also known as the

poverty level expenditures. The universal rebate, paid in advance to all households, is paid in

equal installments each month, without regard to age or income of household dependents. The size

of the rebate is determined solely by the number of dependents within the household, and by the

Department of Health and Human Services’ poverty level multiplied by the tax rate. This is a

well-accepted, long-used, poverty-level calculation that includes food, clothing, shelter,

transportation, medical care. See Figure 1 below.

Figure 1: 2011 Family Consumption Allowance and Rebate

» back to FAQ index

-

Why not just exempt food and medicine from the tax? Wouldn’t that be fair and simple?

Exempting items by

category is neither fair nor simple. Respected economists have shown

that the wealthy spend much more on unprepared food, clothing, housing,

and medical care than do the poor. Exempting these goods, as many state

sales taxes do, actually gives the wealthy a disproportionate benefit.

Also, today these purchases are not exempted from

federal taxation. The purchase of food, clothing, and medical services

is made from after income tax and after

payroll tax dollars, while their purchase price hides the cost of

corporate taxes and private sector compliance costs.

Finally, exempting one product or service, but not another, opens the

door to the army of lobbyists and special interest groups that plague

and distort our taxation system today. Those who have the money will

send their lobbyists to Washington to obtain special tax breaks in

their own self-interest. This process causes unfair and inefficient

distortions in our economy and must be stopped.

» back to FAQ index

-

Is the 23% inclusive FairTax rate

higher or lower when compared to the income taxes people pay today?

Most people are paying that much or more today – much

of it is just hidden from view. The income tax bracket most people fall

into is 15% and all wage earners pay 7.65% in payroll taxes. That’s a

total of 23.65% right there, without taking into account the 7.65%

employer matching! On top of that, you have to add in all of the taxes

embedded in the goods you buy (another 20% to 30%).

EFFECTIVE TAX RATES VS. STATED TAX RATES

Because the 23% inclusive FairTax (30% sales tax at the register) would not

be imposed on necessities (rebate), an individual spending $28,000 on

taxable items would pay an effective tax rate of only 14.05%, not

23% (stated tax rate). This effective tax rate would be even lower when

adjusted for spending on nontaxed items.

That same individual will pay 17.3% of his or her income for federal

taxes under the current income tax law regardless of his or her spending

choices. Also, the employer would pay an additional 7.65% in FICA matching

taxes for that person.

» Calculate

your FairTax effective tax rate based on your income/spending

» back to FAQ index

-

Does the FairTax rate need to be much

higher to be revenue neutral?

The proper tax rate has

been carefully worked out; 23 percent does the job of: (1) raising the

same amount of federal funds as is raised by the current system, (2)

paying the universal rebate, and (3) paying the collection fees to

retailers and state governments. Unlike some other proposals, this rate

has been independently confirmed by several different, non-partisan

institutions across the country. Detailed calculations are available

from FairTax.org.

» back to FAQ

index

-

How is the Social Security system

affected under the FairTax?

Like all federal spending

programs, Social Security operates exactly as it does today, except

that its funds come from a broad, progressive sales tax, rather than a

narrow, regressive payroll tax. Employers will report wages for each

employee to the Social Security Administration for the determination

of benefits. The transition to a reformed Social Security system will

be eased while ensuring there is sufficient funding to continue promised

benefits.

» back to FAQ

index

-

How does the FairTax affect Social Security reform?

FairTax.org is a

one-issue organization: income tax replacement. However, its proposal does

benefit any Social Security reform proposal. The

FairTax.org plan does not change Social Security benefits or the

structure of the Social Security system. All it does is replace the

current revenue source (narrow, regressive payroll taxes) with a new

revenue source (a broad, progressive sales tax paid by all consumers

including U.S. citizens, illegal immigrants and foreigh visitors).

Additionally, research shows that consumption is a more stable revenue

source than income. If Social Security is reformed or privatized in a

way that reduces the government’s need for revenue, then the FairTax

rate can be reduced. For example, if a mandatory private savings

program is implemented where people must save 10 percent of their

income and Social Security benefits are curtailed, then the FairTax

rate can be reduced just as payroll taxes would be reduced.

» back to FAQ

index

-

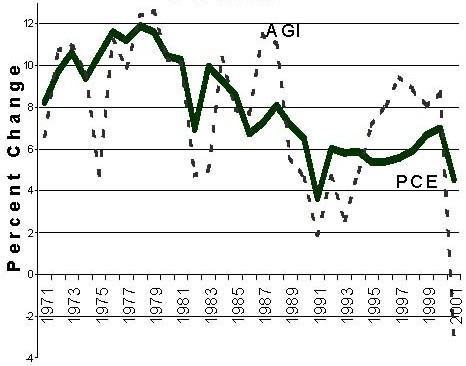

Is consumption a reliable source of revenue?

Yes, in fact, consumption

is a more stable source of revenue than income. A recent study by

American Farm Bureau economist Ross Korves shows the FairTax base was

less variable than the income tax base. Why? Because during difficult

times due to loss of a job or an inability to work, people may not have

as much income, or may have no income at all. They borrow funds or use

savings. They may not have earnings, but they still continue to

consume. Korves’s Figure 2 below shows the yearly changes in the tax

base, adjusted gross income (AGI), under the current tax system for

1971-2001 and changes in personal consumption expenditures (PCE) of the

same time period.

Figure 2: Stability of the Tax Base - 1971 to 2001

» back to FAQ index

-

How is the tax collected?

Retail businesses collect

the tax from the consumer, just as state sales tax systems already do

in 45 states; the FairTax will simply be an additional line on the

current sales tax reporting form. Retailers simply collect the tax and

send it to the state taxing authority. All businesses serving as

collection agents will receive a fee for collection, and the states

will also receive a collection fee. The tax revenues from the states

will then be sent to the U.S. Treasury.

» back to FAQ

index

-

Why is the FairTax better than our current system?

Our present tax system is

one of the reasons that people are finding it so difficult to get ahead

these days. It is one of the reasons the next generation may not have a

standard of living as high as this generation. Cars replaced the horse

and buggy, the telephone replaced the telegraph, and the FairTax

replaces the income tax. The income tax is holding us back and making

it more difficult than it needs to be to improve our families’ standard

of living. It makes it needlessly difficult for our businesses to

compete in international markets. It wastes vast resources on complying

with needless paperwork. We can do better and we must.

» back to FAQ index

-

Is the FairTax fair?

Yes, the FairTax is fair,

and in fact, much fairer than the income tax. Wealthy people spend more

money than other individuals. They buy expensive cars, big houses, and

yachts. They buy filet mignon instead of hamburger, fine wine instead

of beer, designer dresses and expensive jewelry. The FairTax taxes them

on these purchases. If, however, they use their money to build

job-creating factories, finance research and development to create new

products, or fund charitable activities (all of which help improve the

standard of living of others), then those activities are not taxed.

» back to FAQ index

-

How does the FairTax protect low-income families and

individuals and retirees on fixed incomes?

Under the FairTax plan,

poor people pay no federal taxes at all up to the poverty level! Every

household receives a rebate that is equal to the FairTax paid on

essential goods and services, and wage earners are no longer subject to

the most regressive and burdensome tax of all, the payroll tax. Those

spending at twice the poverty level will pay a tax of only 11.5 percent

– a rate much lower than the income and payroll tax burden they bear

today. Moreover, slow economic growth and recessions have a

disproportionately adverse impact on lower income families.

Breadwinners in these families are more likely to lose their jobs, are

less likely to have the resources to weather bad economic times, and

are more in need of the initial employment opportunities that a

dynamic, growing economy provides. The FairTax dramatically improves

economic growth and wage rates. Retaining the present tax system makes

economic progress needlessly slow, thus harming low-income people the

most.

» back to FAQ index

-

Is it fair for rich people to get the exact same FairTax rebate

from the federal government as the poorest person in America?

Let’s look at a

billionaire under the FairTax – if he spends $10,000,000 dollars he

pays a tax of $2,300,000 and gets a rebate of $4,283 (assuming he is

married and has no children). His effective tax rate is 22.96 percent.

Now, let’s look at a middle-income married couple, under the FairTax,

with no children – if they spend $40,000, they pay

$4,917 net after their rebate for an effective tax rate of 12.3

percent. The effective tax rate increases or decreases as spending on

taxable items increases or decreases, but it can never

exceed a 23 percent inclusive rate!

| DESCRIPTION |

FAIR TAX |

INCOME TAX |

| Expenditures=Income |

$40,000 |

$40,000 |

| Net Tax |

$4,917 |

$6,005 |

| Effective tax rate |

12.3% |

15.0% |

Figure 3: Comparison of Effective Tax Rates

FairTax vs Income Tax

In contrast, this same

couple, if they earn $40,000 in wages today under

the income tax, pays $3,060 in payroll taxes and $2,945 in income taxes

for a total of $6,005 in taxes (15.0 percent). In addition, their

employer pays another $3,060 in payroll taxes. Most economists agree

that the employer payroll tax is actually borne by employees in the

form of lower wages. Looked at this way, this couple is paying $9,065

(22.6 percent) in taxes today, which doesn’t even include the hidden

taxes they pay every time they make a purchase. Therefore, a

middle-income married couple with no children has an effective FairTax

rate of 12.3 percent, compared to their effective income tax rate of

22.6 percent!

Finally, let’s look at a low-income couple under the FairTax – they

pay no federal tax at all. Today, under the income tax

system, they not only pay 15 percent in payroll taxes, but they also

pay at least 20 percent in hidden corporate taxes, private sector

compliance costs, and payroll taxes buried in the cost of every product

they buy.

» back to FAQ index

-

What about senior citizens and retired people?

As a group, seniors do

very well under the FairTax. Low-income seniors are much better off

under the FairTax than under the current income tax system. Seniors,

like everyone else, receive a monthly rebate, in advance of purchases,

for taxes paid on the cost of necessities. The income tax imposed on

Social Security benefits is repealed. The income tax imposed on

investment income and pension benefits or IRA withdrawals is repealed.

Pension funds, IRAs, and 401(k) plans had assets of $6.5 trillion in

1994. An income tax deduction was taken for contributions to most of

these plans. All beneficiaries and owners of these plans expected to

pay income tax on them upon withdrawal but will not be required to do

so after passage of the FairTax.

All owners of existing homes experience large capital gains due to the

repeal of the income tax and implementation of the FairTax plan.

Seniors have dramatically higher home ownership rates than other age

groups (81 percent for seniors compared to 65 percent on average).

Homes are often a family’s largest asset. Gains are likely to be in the

range of 20 percent.

The FairTax makes the economy much more dynamic and prosperous.

Consequently, federal tax revenues grow. This makes it less likely that

federal budget pressures require Medicare or Social Security benefit

cuts.

» back to FAQ index

-

Are Seniors taxed twice on savings, once when they saved it,

and now again when the spend it?

No. As surprising as it

may sound, prices at the cash register will not go up under the

FairTax. Simply put, the FairTax is a revenue-neutral proposal, raising

no more money than does the current system. The FairTax only changes

where the money is raised, not the amount. Therefore, the FairTax is

also price neutral.

The price of every good or service we buy today is inflated by the cost

of corporate income taxes, private sector compliance costs, and payroll

matching taxes. These costs are passed on to consumers in the form of

higher prices (or lost jobs or lower profits/dividends).

When income and payroll taxes are repealed, pre-tax prices can come

down 20 to 25 percent according to Dale Jorgenson, Ph.D., chairman of

the Harvard University Economics Department. Furthermore, used goods

are not taxed because they have already been taxed once – when they

were new. Therefore senior citizens, like all Americans, do not lose

purchasing power, but gain it instead. Government benefits are

maintained. Seniors receive a monthly rebate so they don’t pay taxes on

the purchase of necessities. Tax-deferred investments get a one-time

windfall. Savings invested in any long-term, income-generating asset

such as a stock, real estate, or a long-term bond that can’t be called,

will increase substantially in value. Finally, complex estate planning

becomes an artifact of an earlier age.

» back to FAQ index

-

How much do prices for goods and services go down

under the FairTax?

All goods and services

already contain the embedded costs of the current tax system in their

prices. When these embedded taxes are removed, prices come down. Dale

Jorgenson, Ph.D., chairman of the Economics Department at Harvard

University, has projected an average producer price reduction of 20

percent in just the first year after the adoption of the FairTax. In

addition, the FairTax lowers compliance costs by an estimated 95

percent and the removal of these costs will force prices down even

lower.

» back to FAQ index

-

Should the government tax medicine and health care?

Because federal income

and payroll taxes are embedded in the price of everything you buy, you

are already paying federal taxes on the drugs and

other health care services that you buy today – they are just hidden.

After passage of the FairTax, prices (even including the FairTax) may

not go up at all. Harvard economist Dale Jorgenson estimates that

service prices will decline by 25 percent because of the repeal of the

income tax.

» back to FAQ

index

-

Should the government tax services?

Service providers are

not exempt from the income tax today, and should not be exempt from the

FairTax. Services now account for well over one-half of the gross

domestic product (GDP). Neither consumption of services nor consumption

of goods should be tax preferred. And it is economically foolish not to

tax the fastest growing segment of our economy. Competition, not

politics, should determine what goods and services cost.

» back to FAQ

index

-

How does the FairTax affect income tax preparers,

accountants, and many government employees?

There will, of course,

still be some people who are involved in sales tax return preparation

and sales administration under the FairTax, but many fewer than those

involved with the income tax today. Those tax preparers, tax lawyers,

and Internal Revenue Service employees will have to find other, more

productive work. We have nothing to show for the $250 billion

(three Iraq wars worth) that we spend each year measuring, tracking,

sheltering, documenting, and filing our annual income. Surely

these valuable labor and capital resources can be employed more

productively, such as following the money trails left by terrorist,

drug, and other criminal enterprises, rather than trackingevery

American wage earner.

» back to FAQ

index

-

What about the home mortgage deduction?

The FairTax has positive

effects on residential real estate far beyond this narrow question.

Under the current tax system, homeowners that itemize (and 70% do not),

pay their mortgage interest with post-Social Security/pre-income tax

dollars. However, they pay their mortgage principal with

post-SS/post-income tax dollars. In other words, anyone paying a

mortgage today is paying the entire payment with after tax dollars,

thus paying taxes on all or part of their mortgage, whether it was a

new house or an old one. Those who do not itemize get no advantages at

all regarding the post tax dollars spent on the interest.

Under the FairTax, all homeowners make their entire

house payment with pre-tax dollars. Sales tax will only be

charged on new homes when purchased (equal in tax cost with the current

system of post-tax dollars). All used homes under Fair Tax will not be

taxed, which is quite an advantage over the current system of post-tax

payments.

With the FairTax, mortgage interest rates fall by about 25 percent

(about 1.75 points) as bank overhead falls; this is a huge savings for

consumers. For example, on a $150,000, thirty-year home mortgage at an

interest rate of 7.00 percent, the monthly mortgage payment would be

$999.12. On that same mortgage at a 5.25 percent interest rate, the

monthly payment would be $830.01. Over 30 years, the 1.75-percent

decrease in interest rates in this instance would result in a $60,879

cost savings to the consumer.

Finally, first-time buyers save for that down payment much faster, as

savings are not taxed. Under the FairTax, home ownership is a

possibility for many who have never had that option under the income

tax system. Lower interest rates, the repeal of the income tax, the

repeal of all payroll taxes, and the rebate mean

that people have more money to spend, and have an increased opportunity

to become home owners.

» back to FAQ index

-

What will happen to charitable giving?

Charitable

contributions depend on one factor more than any other: The health of

the economy not tax benefits. As a wide range of

economists agree on the economic expansion the FairTax delivers,

charitable contributions benefit also.

For all of the money that pours into churches every Sunday and into a

broad range of charities every day, only the 30 percent who itemize get

any tax benefit. The other 70 percent have given and keep giving with

no tax benefit whatsoever.

The FairTax allows people to make charitable contributions out of pre-tax

dollars. Thus those generally less affluent taxpayers who do

not itemize see their cost of charitable giving go down under the

FairTax.

Finally, the wealthy make decisions on charitable giving based on the

cause. Once they have determined the cause is worthy, their

contribution is structured to maximize the gift and minimize the tax.

But the intention to give comes first; taxes simply determine the

structure – rarely the amount – of the gift.

» back to FAQ index

-

Will corporations get a windfall with the abolition of

the corporate tax?

Corporations are legal

fictions that have not, do not, and never will bear the burden of

taxation. Only people pay taxes. Corporations pass on their tax burden

in the form of higher prices to consumers, lower wages to workers,

and/or lower returns to investors. The idea that taxing a corporation

reduces taxes on, say the working poor, is a cruel hoax. A corporate

tax only makes what the working poor buy more expensive, costs them

jobs, lowers their lifestyle, or delays their retirement. Under the

FairTax plan, money retained in the business and reinvested to create

jobs, build factories, or develop new technologies, pays no tax. This

is the most honest, fair, productive tax system

possible. Free market competition will do the rest.

» back to FAQ index

-

Does the FairTax burden the retail industry?

All businesses are tax

collectors today. They withhold income and payroll taxes from their

employees. Moreover, the vast majority of retail businesses operate in

states with a sales tax (45 states currently use a sales tax) and are

already sales tax collectors. Under the FairTax, retailers are paid a

fee equal to ¼ of one percent of federal sales tax they collect and

remit. In addition, of course, retailers no longer bear the cost of

complying with the income tax, including the uniform capitalization

requirements, the various depreciation schemes, and the various

employee benefit and pension rules. Finally, the aggregate, beneficial

effects of dramatically lower income tax compliance costs, no income

taxes, and a reasonable fee for collecting the FairTax, ensure that

retailers will do quite well.

» back to FAQ index

-

How are state tax systems affected, and can states

adequately collect a federal sales tax?

No state is required to

repeal its income tax or piggyback its sales tax on the federal tax.

All states have the opportunity to collect the FairTax; states will

find it beneficial to conform their sales tax to the federal tax. Most

states will probably choose to conform. It makes the administrative

costs of businesses in that state much lower. The state is paid a ¼ of

one percent fee by the federal government to collect the tax. For

states that already collect a sales tax, this fee proves generous. A

state can choose not to collect the federal sales tax, and either

outsource the collection to another state, or opt to have the federal

government collect it directly. If a state chooses to conform to the

federal tax base, they will raise the same amount of state sales tax

with a lower tax rate – in some cases more than 50 percent lower –

since the FairTax base is broader than their current tax base. States

may also consider the reduction or elimination of property taxes by

keeping their sales tax rate at or near where it is currently. Finally,

conforming states that are part of the FairTax system will find

collection of sales tax on Internet and mail-order retail sales greatly

simplified.

» back to FAQ index

-

How will the plan affect economic growth?

With the penalty for

working harder and producing more removed, Americans are free to keep

every dollar they earn, and a new era of economic growth and job

creation is unleashed. Americans are able to save more, and businesses

will invest more. Capital formation, the real source of job creation

and innovation, is facilitated. Gross domestic product (GDP) increases

by an estimated 10.5 percent in the first year alone. The FairTax as

proposed raises the economy’s capital stock by 42 percent, its labor

supply by four percent, its output by 12 percent, and its real wage

rate by eight percent.

As U.S. companies and individuals repatriate, on a tax-free basis,

income generated overseas, huge amounts of new capital flood into the

United States. With such a huge capital supply, real interest rates

remain low. Additionally, other international investors will seek to

invest here to avoid taxes on income in their own countries, thereby

further spurring the growth of our own economy.

» back to FAQ index

-

What economic changes come at the retail level with

the FairTax?

Our baby boom generation

has been trained to spend money before inflation eats it up or savings

is taxed away. This group, for good or evil, will likely spend their

initial pay raise. Others will recognize the advantages of savings and

investment. There will be a whole new round of home refinancings. There

will likely be a lot of interest in the actual cost of the federal

government when consumers see their most recent contribution at the

bottom of each retail receipt.

Since the FairTax plan is revenue neutral, the same

amount of resources is extracted from the economy as is extracted under

current law. These funds are, however, extracted in a less economically

damaging way. Every known economic projection shows the economy doing

better, often much better, under the FairTax.

Because the economy grows, is more efficient, and more productive,

while investment, wages and consumption are higher than they are under

the income tax.

» back to FAQ index

-

What happens to interest rates?

First, interest rates

drop quickly by approximately one-quarter. Interest rates include

compensation to the lender for the tax that they must pay on interest

you pay them. That is why taxable bonds bear a higher interest rate

than tax-exempt bonds. When the tax on interest is removed, interest

rates will drop toward today’s tax-exempt rate.

Second, under the current system, savings and investments are taxed.

Under the FairTax, savings and investments are not be taxed at all. As

Americans save more money, the pool of funds in lending institutions

grows. When you add to this the flood of capital currently trapped

offshore, we realize a huge increase in the pool of capital, thereby

causing the cost of borrowing funds to drop.

» back to FAQ index

-

What happens to the stock market, mutual funds, and

retirement funds?

Investors prosper

greatly under this plan, since corporations face lower operating costs

and individuals have more money to save and invest. The reform

significantly enhances the retirement savings and/or retirement

spending power of most Americans.

» back to FAQ index

-

What happens to tax-free bonds?

Tax-free bonds are still

tax-free, though they are now directly competitive with corporate

bonds. Under the FairTax equities, treasuries, bonds, and other

investments are all tax-free. There is a one-time windfall in

non-callable instruments, such as corporate bonds; this windfall also

has a positive effect on callable instruments with some time remaining

to the call date, including treasuries.

» back to FAQ index

-

How does this affect U.S. competitiveness in foreign

trade?

Since all U.S. exporters

immediately see an average 20-percent reduction in their production

costs, they experience an immediate boost in their competitiveness

overseas. American companies doing business internationally are able to

sell their goods at lower prices but similar margins, and this brings

jobs to America.

In addition, U.S. companies with investments or plants abroad will

bring home overseas profits without the penalty of paying income taxes,

thus resulting in more U.S. capital investment.

And at last, imports and domestic production are on a level playing

field. Exported goods are not subject to the

FairTax, since they are not consumed in the U.S.; but imported goods

sold in the U.S. are subject to the FairTax because

these products are consumed domestically.

» back to FAQ index

-

What about border issues?

It is unlikely that

“shopping across the border” in Canada or Mexico will result in any

cost savings to the consumer. Remember, the FairTax is revenue neutral

and therefore price neutral. This means the final cost of retail goods

and services after the FairTax remains very close to the same levels

found in the marketplace today. With regard to interstate competition,

since all states have the same federal sales tax rate, the federal

sales tax is not an incentive to cross state lines to avoid the tax.

» back to FAQ index

-

Does the FairTax improve compliance and reduce evasion

when compared to the current income tax?

The old aphorism that

nothing is certain except death and taxes should be modified to include

tax evasion. Tax evasion is chronic under any system so complex as to

be incomprehensible. As a percentage of gross domestic product (GDP),

tax evasion is beyond 2.0 percent, compared to 1.6 percent in 1991. Tax

evasion continues to be in the range of one quarter of income taxes

collected. Almost 40 percent of the public, according to the IRS, is

out of compliance with the present tax system, mostly unintentionally

due to the enormous complexity of the present system. These IRS figures

do not include taxes lost on

illegal sources of income with a criminal economy estimated at a trillion

dollars. All this, despite a major enforcement effort and

assessment of tens of millions of civil penalties on American taxpayers

in an effort to force compliance with the tax system. Disrespect for

the tax system and the law has reached dangerous levels and makes a

system based on taxpayer self-assessment less and less viable.

The FairTax reduces rather than increases the problem of tax evasion.

The increased fairness, transparency, and legitimacy of the system will

induce more compliance. The roughly 90-percent reduction in filers

enables tax administrators more narrowly and effectively to address

non-compliance and increases the likelihood of tax evasion discovery.

The relative simplicity of the FairTax promotes compliance. Businesses

need answer only one question to determine the tax due: How

much was sold to consumers?

Finally, because tax rates decrease, tax evasion is less profitable;

and because of the dramatic reduction in the number of tax filers, tax

evaders are be more easily monitored and caught under the FairTax

system.

» back to FAQ index

-

Can the FairTax really be passed into law?

Do women have the right

to vote in this country? Did we pass Prohibition? Did we repeal it? Do

Blacks enjoy freedoms far beyond the lunch counter and mass transit? Do

free-market economies dominate Eastern Europe, peoples once under the

boot of communism? All these were grassroots efforts that effected

significant changes in our nation and the world. Is the current income

tax system any less a yoke around the necks of otherwise free peoples?

We think not.

Passing the original 16th Amendment and the income tax wasn’t easy and

repealing the income tax and the 16th Amendment won’t be easy either.

That is why the FairTax has undertaken to build a grassroots movement

and grassroots alliances to support the effort. When enough people make

it clear to Washington that they want change, it will happen. But it

will only happen if the American people rally behind the effort, throw

off the yoke, and demand a redress of wrongs.

» back to FAQ index

-

What other significant economies use such a tax plan?

Two of the largest

economies in the world rely almost solely on sales taxes: Florida and

Texas. Many civilizations in history have relied solely on

transaction-based consumption taxes: A percentage of a grain shipment

in exchange for a safe harbor. Even a cursory study of history shows

that nation/states that relied on consumption taxes flourished and

prospered, supported democracies/republics, had expanding economies,

and high levels of civil rights for their citizens. The exact opposite

is true for empires that relied on income/poll/head taxes. These taxes

were used to support despots, eventually collapsed the economies in

which they were applied, and sundered civil rights.

The sales tax is a familiar tax, being a major source of revenue in 45

states and the District of Columbia. It is true, however, that no

post-industrial nation, until now, has ever repealed

its income tax and replaced it with a federal

retail sales tax. However, England did repeal its detested income tax

upon the defeat of Napoleon and enjoyed the fastest, longest expansion

of its economy in its long history. An expansion that ended only with

the – you guessed it – re-imposition of an income tax.

No other country has a system of government like ours, and no other

country has led the world in so many fields as ours. It was France and

Germany that forced the imposition of a VAT in addition

to income taxes across the European Community. Shall we follow France’s

lead? In contrast, we can observe the Irish Miracle that stems from

their refusal to join the EC and their choice to follow their own path

on taxation. Thus, we should simply strive to have the best tax system,

period.

» back to FAQ index

-

What about the flat tax? Would it be better and easier

to pass?

The flat tax and the

FairTax share some important similarities. They are both flat-rate

taxes that are neutral with respect to savings and investment. The flat

tax, however, retains the invasive income tax administration apparatus

and can easily revert to a graduated, convoluted mess, as it has many

times over many years.

Very few people really understand the flat tax. Its authors will tell

you it is a consumption tax that uses the income tax system for

implementation. Only an academic or government bureaucrat would dream

up a consumption tax that needs the invasive income tax apparatus for

its application, when one can simply have a retail sales tax and reduce

the bureaucracy by 90 percent or more! In addition, a large part of the

burden of the flat tax – the business tax – will remain hidden from

people in the retail price of goods and services.

In contrast, the FairTax is simple, easy to understand, and visible. It

cannot be converted into an income tax.

Under a flat tax, individuals would still file an income tax return

each year similar to today’s 1040 EZ. While this is a simple postcard,

the record keeping required to fill in the blanks is still long and

burdensome. Under the FairTax, individuals would never file a tax

return again, ever! Under the flat tax, the payroll tax would be

retained and income tax withholding would still be with us. Under the

FairTax, the payroll tax, which is a larger and more regressive tax

burden for most Americans than is the income tax, would be repealed.

Under the FairTax, what you earn is what you keep. No more with-holding

taxes; no more income tax.

Notwithstanding flat tax proponents’ honorable intentions, income tax

reform has been less than a success in the past. Congress has tried to

reform the income tax again and again, with the result being greater

complexity and, generally, higher rates. The problem is

the income tax, and it is time to stop tinkering with it.

Flat tax supporters have made major political attempts to pass their

reform, including the efforts of former Majority Leader Dick Armey and

presidential candidate Steve Forbes, and yet, their efforts have not

progressed politically for several years. With every debate, the flat

tax loses grassroots and congressional support to the FairTax. It is

time to junk the entire income tax system and start over with a tax

system that is more appropriate for a free society and better able to

meet the needs of the information age.

» back to FAQ index

-

Can Congress just simply raise the rate once the

FairTax is passed into law?

Yes, of course Congress

can raise the FairTax rate just as it could raise the flat tax rate or

can and does raise the income tax rate. And if we in the grassroots

allow them to do it, shame on us!

However, the FairTax is highly visible. And because there is only one

tax rate, it will be very hard for Congress to adopt the typical

divide-and-conquer, hide-and-disguise, strategy employed today to

ratchet up the burden gradually, by manipulating the income tax code.

Ultimately, the tax rate will be dictated by the size of government. If

government gets larger, higher tax rates will be required. If

government shrinks relative to the economy, then the tax rate will

fall. Federalist 21, by Alexander Hamilton, is a

great read on the futility of government raising a consumption tax too

high, and thus reducing revenues.

» back to FAQ index

-

Could we end up with both the FairTax and an income

tax?

No current supporter of

the FairTax would support the FairTax unless the entire income tax is

repealed. Moreover, concurrent with the repeal of the income tax, a

constitutional amendment repealing the 16th Amendment and prohibiting

an income tax will be pushed through Congress for ratification by the

states.

» back to FAQ index

-

Is the FairTax just another conservative tax scheme?

Or just another liberal tax scheme?

The FairTax has

non-partisan support from people in all walks of life. From both major

parties and several third parties. Its supporters need only have one

common belief: That it is a fairer, simpler, more efficient way to

raise federal revenue. The FairTax delivers these benefits to all

American people and more. More government accountability for taxpayer

dollars, a tax system that is less susceptible to being manipulated by

special interests, a tax system that will make it easier – not harder –

for the average person to get ahead, and perhaps most importantly, a

tax system that provides real, honest, and transparent tax relief for

those who need it most.

» back to FAQ index

-

What assumptions have been made about government spending?

The FairTax plan is

devised to be revenue neutral for the first year of operation. It

raises the same amount of revenue as is raised by current law. After

the first year, revenue is expected to rise because of the growth

generated by this plan. At that time the American people, the Congress,

and the President will have to decide whether to lower the tax rate, or

to spend the additional revenue.

» back to FAQ index

-

How does the FairTax affect government spending?

The public must remain

vigilant to ensure that the economic gains caused by the FairTax

benefit the people and the causes they deem worthy. However, it is

easier to determine if your elected representatives are acting in your

best interest. Legislators can more easily be held accountable for

their decisions. For the first time in decades, it is simple to see

whether a politician is advocating an increase in taxes or a restraint

on government spending as the economic pie gets bigger. This is not the

case today.

» back to FAQ index

-

Why is it necessary to have a constitutional amendment?

It is not the intention

of this plan, or the desire of the American people, to end up with both

a federal income tax and a federal sales tax. The objective is to

ensure that one is replaced by the other, not added on top of the

other. By repealing the 16th Amendment, we close the door on an income

tax for generations to come.

» back to FAQ index

-

How does the income tax affect our economy?

How does dragging an

anchor affect the speed of a ship? Our entire economy is not

dependent on the income tax. Instead our economy is held back by the

income tax. There was no income tax for the first 124 years of our

history – that’s more than half the time we have existed as a nation.

Under the FairTax, within ten years, average Americans will be at least

10 percent and probably 15 percent better off than they would be under

the current system. That translates to an increase of $3,000 to $4,500

per household.

» back to FAQ index

-

How will this plan affect compliance costs?

It is estimated that

Americans spend at least $250 billion a year to comply with the tax

code – that’s $850 for every man, woman, and child in America. That is

the cost of three Iraq wars. Billions of dollars in compliance costs

are wasted each year, and we have nothing of value to show for this

expenditure – not one single productive service or product is added to

our nation’s wealth. It is estimated that the FairTax dramatically cuts

such compliance costs, perhaps as much as 95 percent.

» back to FAQ index

-

What about value-added taxes (VATs), like they have in

Europe and Canada? Are they not consumption taxes?

While VATs are also

consumption taxes, and better than income taxes, the FairTax is not a

VAT. A VAT works very differently. It taxes every stage of production.

It is much more complex, and is typically hidden from the retail

consumer. Second, in industrialized countries that have a VAT, it

coexists with high-rate income tax, payroll and many other taxes that,

in some instances, have led to marginal tax rates as high as 70

percent. Third, all other industrialized countries, except Australia

and Japan, have a much larger tax burden than the U.S., which requires

higher rates and makes tax administration much more difficult. Lastly,

a VAT is a lobbyist’s dream, allowing them to install their loopholes

unbeknownst to the retail purchaser. A retail sales tax, in contrast,

is a lobbyist’s nightmare, applied as it is under the bright lights of

the retail counter.

» back to FAQ index

-

What will we experience in the transition from the

income tax to the FairTax?

Everyone will have to

think about taxes in a different way. Income – what we earn – will no

longer have to be documented, measured and kept-track-of for tax

purposes. The only relevant measure of our tax liability will be the

amount we choose to spend on final, discretionary consumption.

Tax-related issues will suddenly be a lot simpler and more

straightforward than they used to be. The aggravation and anxiety

associated with “April 15th ” will disappear forever after passage of

the FairTax. The FairTax is not new; most Americans come into contact

with such taxes daily, since 45 states currently use them to collect

state revenues. It is easier to switch from an income tax to the

FairTax system than it is to switch from gallons to liters, or from

feet to meters! Of course, those who depend on the structure and

complexity of our current system (e.g., tax lobbyists, tax preparers,

and tax shelter promoters) will have to find more productive economic

pursuits. However, everyone will have enough advance notice to adjust

to the new system.

Job creation will boom. Residential real estate will boom. Financial

services will boom. Exports will boom. Retail will prosper. Farming and

ranching will prosper. Churches and charities will prosper. Civil

liberties will be enhanced. In short, it is difficult to imagine the

far-reaching, positive effects of this change. Though this tax policy

is exactly what our Founding Fathers counseled us to do with the Federalist

Papers and the Constitution.

» back to FAQ index

-

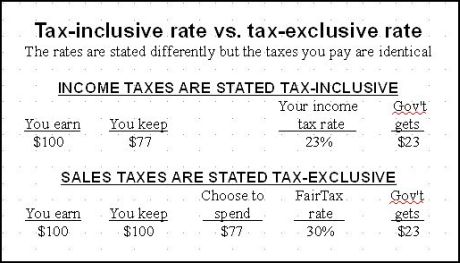

I know the FairTax rate is 23 percent when compared to

current income taxes. What will the rate of the sales tax be at the

retail counter?

This issue is often confusing, so we explain more here.

The rate of the sales tax at the retail counter is 30 percent.

When income tax rates are quoted, economists call that a tax-inclusive

rate: “I paid 23 percent last year.” In that case, for $100 earned, $23

went to Uncle Sam. Or, “I had to make $130 to have $100 to spend.” That’s

a 23-percent tax-inclusive rate. We choose to compare the FairTax

to income taxes, quoting the rate the same way, because the FairTax

replaces such taxes. That rate is 23 percent inclusive.

Sales taxes, on the other hand, are generally quoted tax-exclusive:

“I bought a $77 shirt and had to pay 30 percent sales tax on the $77,

amounting to that same $23 tax, for a total of $100 spent on the shirt.

This is a 30-percent sales tax.” Or, “I spent $100 dollars, $77 for the

shirt and $23 in sales tax.” This rate, when programmed into a

point-of-purchase terminal, is a 30 percent tax.

Note that no matter which way it is quoted, the amount of tax is the

same dollar amount ($23) and you maintained the same buying power

($77). Under an inclusive income tax rate of 23 percent, you have to

earn $130 to spend $100. Spend that same $100 under a sales tax, you

pay that same $30, and the rate is quoted as 30 percent. Figure 4 below

shows in chart form the differences in these two methods of quoting

tax rates. Notice the amount of tax paid is the same in both cases.

Perhaps the biggest difference between the two systems is the ability to

control your tax rate and, therefore, the amount of tax that must be paid.

Under the federal income tax system, controlling the amount of tax you pay

is a complex nightmare. However, under the FairTax, you may simply choose

to spend less, spend on used goods not taxed, invest (earnings are not taxed),

or choose to not spend at all to control your own annual tax rate.

Figure 4: Tax-inclusive vs. Tax-exclusive Rates

» Alternative

explanation of 23% Inclusive and 30% Exclusive tax rate with example

» back to FAQ index

-

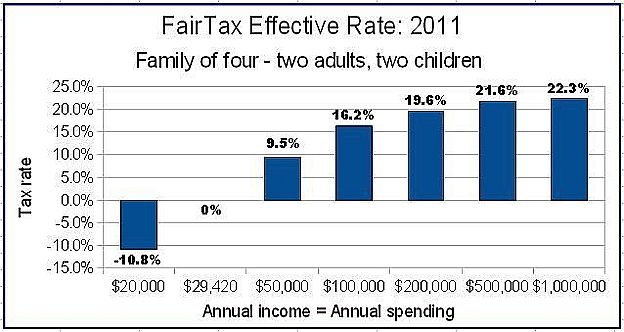

Is the FairTax progressive? Do the rich pay more and

the poor pay less as a percentage of their spending?

Absolutely, as you can

see in Figure 5 below – where the graph shows annual expenditures for a

family of four and the corresponding FairTax effective tax rates. The

poor can actually pay less than zero-percent retail sales tax on their

spending. Much like with the earned income tax credit of today, the

rebate may give them more money than they actually spend on retail

taxes. Especially if they are frugal and buy mostly used products. On

the other hand, the wealthy approach a maximum of 23-percent retail

sales tax on their spending.

Figure 5: Annual expenditures vs. FairTax effective tax rates for a family of four

» back to FAQ index

-

Can you summarize House bill H.R. 25 - "The Fair Tax Act"?

The FairTax Act (H.R. 25 and companion legislation in the Senate, S. 122) is a

non-partisan proposal that abolishes all federal income

taxes, including personal, estate, gift, capital gains, alternative

minimum, corporate, Social Security, other payroll, and self-employment

taxes, and replaces them all with one simple, visible, federal retail

sales tax. The FairTax dramatically changes the basis for taxation by

eliminating the root of the problem: taxing income. The FairTax taxes

us only on what we choose to spend, not on what we earn. It does not

raise any more or less revenue, i.e., it is designed to be revenue neutral.

The FairTax is a fair, efficient, and intelligent solution to the

frustration and inequity of our current tax system.

» back to FAQ index

-

Who are the Americans for Fair Taxation (AFFT) - FairTax.org?

Americans for Fair

Taxation, known as AFFT or just FairTax.org is a non-profit,

non-partisan, grassroots organization dedicated to replacing the

current tax. The organization has hundreds of thousands of members and

volunteers nationwide, with over 8,000 in Pennsylvania alone. Its plan

supports sound economic research, education of citizens and community

leaders, and grassroots mobilization efforts. For more information,

visit the AFFT web site, fairtax.org, or call 1-800-FAIRTAX

nationally or 724-941-9443 in Pennsylvania.

» back to FAQ index

"All tyranny needs to gain a foothold is for

people of good conscience to remain silent."

— Thomas Jefferson, former U.S. president and

principal

author of the Declaration of Independence

Home |

Research |

FAQs |

In the News |

Legislators |

Links

Facts |

Resources |

Get Involved! |

Activities |

Song |

Contact

|